Regulation and Cryptocurrency is redefining how investors approach digital assets in 2025. As governments sharpen their lenses on cryptocurrency regulation 2025, investors must understand where the lines are drawn and how this evolving framework could shape portfolios. A clear grasp of regulatory updates crypto and the latest guidance helps readers stay aligned with evolving standards while supporting crypto market compliance. The convergence of technology and policy means due diligence is no longer optional for those seeking long-term growth in digital assets, with investor protections cryptocurrency becoming a core criterion. This article outlines how the regulatory landscape is evolving across major regions and practical steps to navigate the terrain with confidence as global crypto regulations continue to evolve.

Beyond the headline terms, the topic can be framed as a policy framework for digital assets that guides how platforms operate. From a Latent Semantic Indexing perspective, you can think of it as a global regime of digital-asset governance, licensing standards, and risk controls that help investors compare options. Jurisdictional frameworks like licensing mandates, custody requirements, and transparency rules provide a common language for evaluating projects. Ultimately, the focus is on clear disclosures, verifiable reserves, and robust incident response—elements that support trust and sustainable participation. As rules evolve, savvy investors look for governance maturity, regulatory alignment, and accessible compliance pathways that reduce ambiguity and protect capital.

Regulation and Cryptocurrency in 2025: Global Rules, Investor Protections, and Compliance

Regulation and Cryptocurrency in 2025 is reshaping how investors access digital assets, with policymakers outlining clear expectations for registration, disclosure, and risk management. This shift aligns with the themes of cryptocurrency regulation 2025 and the broader push of global crypto regulations, creating a framework where due diligence and governance matter more than ever. Investors benefit from greater clarity on platform responsibilities, reporting standards, and verifiable reserve practices that underpin trust in the market.

As regulatory updates crypto continue to evolve, the emphasis on investor protections cryptocurrency grows louder. Expect stronger custody standards, transparent transaction histories, and independent attestations that reduce counterparty risk. In practice, these changes translate into more rigorous disclosures, auditable security controls, and a governance backbone that helps retail and institutional participants navigate crypto market compliance with greater confidence.

Navigating this landscape requires disciplined diligence: prioritize platforms with clear licensing, robust risk management, and proactive incident response. By aligning portfolios with regulated products and transparent governance, investors can pursue long-term growth while mitigating regulatory risk in a rapidly changing environment.

Regional Pathways to Compliance in 2025: Navigating Global Crypto Regulations and Market Standards

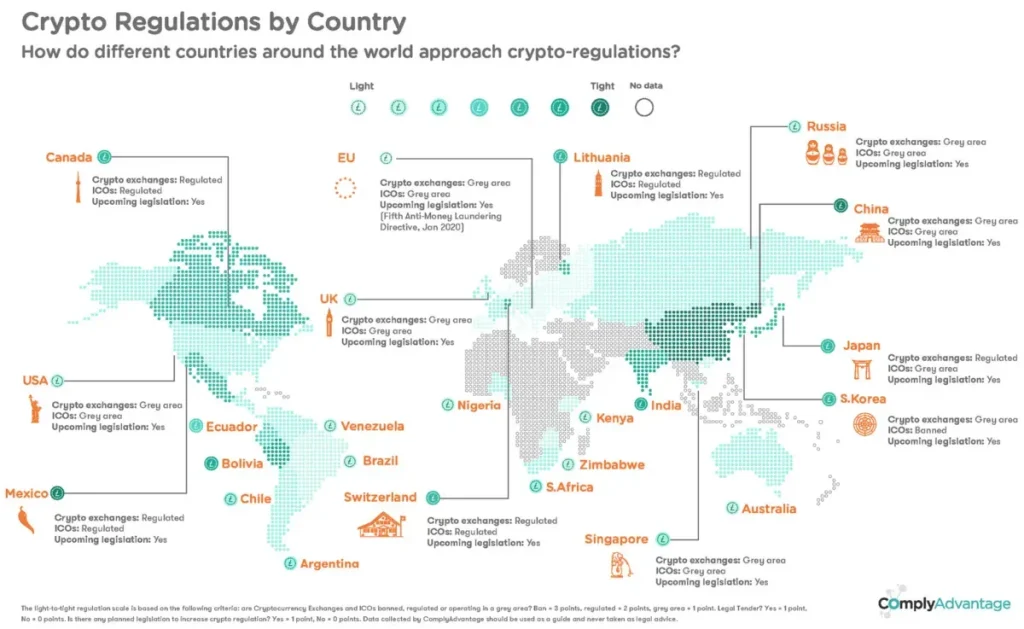

Across the United States, European Union, United Kingdom, and Asia-Pacific, regulatory approaches signal a move toward harmonization while maintaining region-specific safeguards. This regional patchwork—grounded in global crypto regulations—highlights the ongoing process of regulatory updates crypto and the need for buyers to understand token classifications, licensing regimes, and cross-border supervision. Investors who stay informed can better anticipate policy shifts and align their exposure with compliant practices.

Practical investor guidance centers on due diligence, choosing regulated venues, and demanding transparent disclosures. Emphasizing crypto market compliance means favoring exchanges and products that meet local rules, provide proof of reserves, and publish standardized risk material. In parallel, maintaining robust tax records and understanding jurisdictional tax treatment helps protect investor protections cryptocurrency while supporting smoother reporting.

Looking ahead, the industry is likely to see standardized disclosures, enhanced custody and insurance options, and greater cross-border cooperation. As global crypto regulations evolve, a thoughtful, risk-aware approach—anchored in regulatory updates crypto and strong governance—will enable investors to navigate opportunities with greater confidence and resilience.

Frequently Asked Questions

How does cryptocurrency regulation 2025 influence investment strategies and due diligence in the crypto market?

Cryptocurrency regulation 2025 signals stricter token classification, disclosure, custody, and market integrity standards across major jurisdictions. For due diligence, prioritize regulated venues and crypto market compliance: licensing, auditable controls, and proof of reserves. Regulators emphasize transparency, governance, and robust incident response—so align portfolios with compliant products and maintain tax-ready records consistent with global crypto regulations.

What should investors look for to ensure investor protections cryptocurrency amid regulatory updates crypto and evolving global crypto regulations?

To safeguard investments amid regulatory updates crypto and global crypto regulations, prioritize platforms with clear licensing, custody arrangements, and independent audits. Seek products that provide transparent disclosures, governance structures, and proven proof of reserves to uphold investor protections cryptocurrency. Maintain thorough tax and transaction records and stay informed through credible regulatory updates crypto sources to adapt portfolios as rules evolve.

| Key Point | Overview |

|---|---|

| Global Regulatory Patchwork with Common Threads | Regulatory approaches vary by region but share goals: investor protection, transparency, and governance. Common threads include clearer custody, traceable transaction histories, verifiable reserves, and disclosure requirements, though classifications (securities vs. commodities) and supervision differ by jurisdiction. Understanding regional nuances helps anticipate shifts. |

| What to Watch in 2025: Compliance, Tax, and Transparency | Highlights: heightened KYC/AML for exchanges, wallets, and DeFi; token classifications; tax guidance; stablecoins; custody and insurance; and standardized disclosures. Investors should seek platforms with clear compliance roadmaps, auditable security practices, and regular reporting. |

| Regional Deep Dives | US: clarifying if tokens are securities or commodities and platform oversight; EU MiCA standardizes licensing and disclosures; UK emphasizes consumer protections and transparency; Asia-Pacific shows licensing and AML/CFT focus with cross-border considerations. |

| Practical Investor Guidance | Perform thorough due diligence on licensing, custody, and governance; favor regulated products and venues; diversify with risk-aware strategies; maintain detailed tax records; stay informed with credible regulatory updates and avoid overreaction to headlines. |

| The Role of Regulators | Regulators balance innovation with protection, aiming for governance, transparency, and accountability. Requests for proof of reserves, auditable controls, and standardized disclosures help investors but may affect liquidity and product availability. |

| Future Trends | More cross-border harmonization with local adaptations; standardized disclosures and governance metrics; expanded regulated custody and insurance; growing emphasis on retail investor education to improve literacy and resilience in the market. |