Cryptocurrency vs Bitcoin marks the starting line for understanding how digital money differs in purpose, technology, and impact across finance and technology, shaping how individuals, institutions, and developers frame risk, opportunity, and governance in this evolving space. This guide helps explain Bitcoin vs cryptocurrency differences, showing why Bitcoin is often viewed as a store of value while other assets pursue faster payments, smart contracts, or privacy features, and it outlines practical implications for wallets, exchanges, and regulation. To answer what is Bitcoin, consider its fixed supply, decentralized security model, and role as a benchmark within a rapidly evolving ecosystem, alongside a community of miners, developers, and users who contribute to its resilience, openness, and transparency. When you compare cryptocurrencies vs Bitcoin comparison, you see a spectrum from long-term store-of-value narratives to programmable money and specialized applications, and this spectrum helps investors assess diversification strategies, risk tolerance, and the trade-offs between security, speed, and scalability. A blockchain technology overview clarifies how Bitcoin vs altcoins differs in scalability, governance, and network effects, grounding the discussion in concrete technology rather than headlines, while understanding these dynamics helps readers evaluate infrastructure choices, funding models, and future-proofing amid rapid protocol changes.

From a semantic perspective, the second paragraph pivots from blunt labels to the broader landscape of digital currencies and the flagship coin that anchors the market. In this framing, terms like the leading cryptocurrency, decentralized digital assets, and the Bitcoin benchmark help readers grasp how governance, incentives, and consensus drive different networks. By describing networks as blockchain ecosystems, token economies, and cross-chain capabilities, readers gain a richer sense of how value is stored, transferred, and evolved. This Latent Semantic Indexing‑inspired approach emphasizes relationships among assets, technology, and use cases, preparing readers to evaluate projects beyond headlines and to appreciate the diversity of crypto journeys.

Cryptocurrency vs Bitcoin: Core Differences and Use Cases

When we discuss Cryptocurrency vs Bitcoin, the first distinction is breadth versus a single asset. Cryptocurrency refers to the broad family of digital currencies that rely on cryptography and blockchain technology to secure transactions and govern issuance. Bitcoin, by contrast, is one specific cryptocurrency with its own blockchain, serving as a reference point for the entire space. This framing helps readers understand why the cryptocurrency landscape is described as a diverse ecosystem rather than a monolithic market.

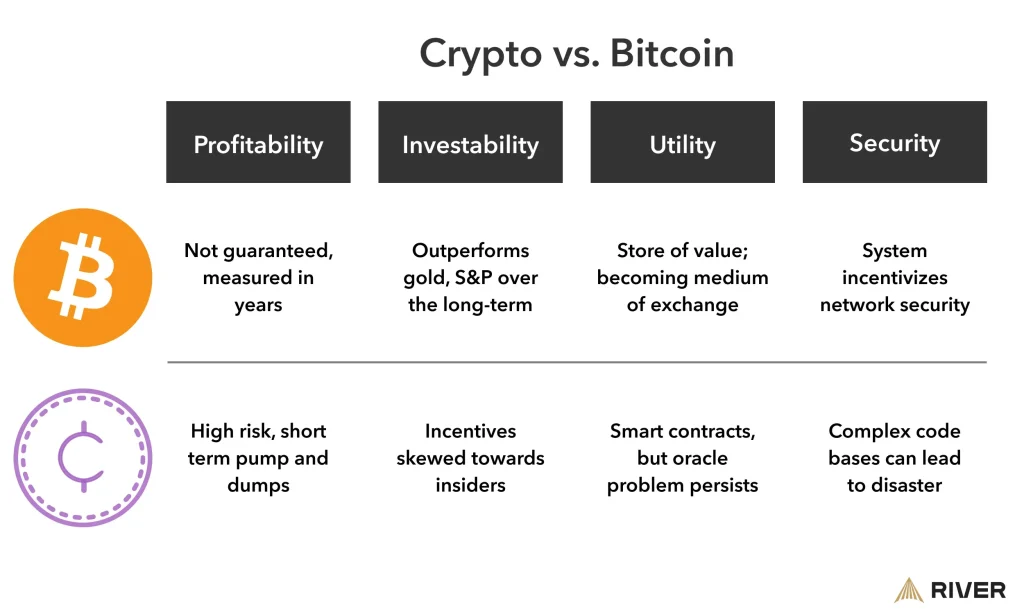

Understanding what is Bitcoin requires recognizing its unique role as a decentralized store of value and, to a growing extent, a medium of exchange. The comparison of cryptocurrencies vs Bitcoin differences often highlights Bitcoin’s capped supply, conservative governance, and robust network security as defining features. At the same time, the broader crypto universe includes projects designed for faster payments, programmable money, privacy enhancements, or specialized applications in fields like DeFi and supply-chain tracking, illustrating the depth of the crypto landscape beyond Bitcoin.

Bitcoin vs Altcoins: Navigating the Ecosystem and Blockchain Technology Overview

Bitcoin vs altcoins frames a spectrum of opportunities and risks. Altcoins encompass all cryptocurrencies other than Bitcoin and collectively offer features such as smart contracts, privacy improvements, and faster settlement. This is where the concept of cryptocurrencies vs Bitcoin comparison becomes practical for investors and users who seek specific capabilities, from programmable money to cross-chain interoperability.

A blockchain technology overview helps readers evaluate how these networks differ in design and execution. Bitcoin relies on a proof-of-work consensus mechanism with a broad mining network and long-term security goals, while many altcoins experiment with alternative approaches like proof-of-stake, layer-two scalability, and governance models that enable more rapid protocol updates. This contrast underpins why Bitcoin versus altcoins matters for understanding risk, innovation, and how different blockchains support diverse use cases.

Frequently Asked Questions

What are the Cryptocurrency vs Bitcoin differences investors should know?

Cryptocurrency vs Bitcoin differences come down to breadth versus a single asset. Cryptocurrency is the umbrella term for all digital currencies that use cryptography and blockchain technology; Bitcoin is a specific cryptocurrency with its own blockchain. Bitcoin is commonly viewed as a digital store of value and a decentralized medium of exchange, while other cryptocurrencies pursue varied goals such as smart contracts, privacy, or faster payments. Key distinctions include Bitcoin’s capped supply of 21 million, its conservative governance approach, and its position as the most liquid and widely recognized asset in the ecosystem.

In a cryptocurrencies vs Bitcoin comparison, how does Bitcoin differ from altcoins and why does it matter?

In a cryptocurrencies vs Bitcoin comparison, Bitcoin remains the first and most recognized cryptocurrency, built on its own blockchain using a proof-of-work model. Its core strengths include a fixed supply, broad liquidity, and governance focused on security and long‑term stability. Altcoins, by contrast, offer diverse features such as smart contracts, enhanced privacy, faster settlement, or cross‑chain interoperability, and they often experiment with different consensus mechanisms and emission schedules. For many readers, Bitcoin serves as a foundational asset within the broader blockchain technology overview, while altcoins provide targeted use cases and growth opportunities within the evolving crypto ecosystem.

| Aspect | Key Points |

|---|---|

| What is Cryptocurrency? | A cryptocurrency is a digital asset that uses cryptography to secure transactions, control creation of new units, and verify transfers. It is a broad category that includes thousands of projects beyond Bitcoin, each with its own blockchain, governance model, and use case. When people refer to Cryptocurrency in general, they are often talking about the broader landscape of digital currencies that rely on decentralized networks rather than centralized authorities. |

| What is Bitcoin? | Bitcoin is the first and most well-known cryptocurrency, launched in 2009 by an anonymous figure or group using the pseudonym Satoshi Nakamoto. Built on a decentralized peer-to-peer network, Bitcoin operates on its own blockchain and remains the primary reference point for the term cryptocurrency in many conversations. Bitcoin’s design emphasizes fixed supply, censorship resistance, and a security model anchored by a large global network of miners and nodes. In short, Bitcoin is a specific cryptocurrency, and it also serves as a symbol and benchmark for the broader space. |

| Core Differences Between Cryptocurrency and Bitcoin | Bitcoin is a single project within a much larger family. Cryptocurrency is the umbrella term for all digital currencies that use cryptography and blockchain technology; Bitcoin is a single cryptocurrency with its own blockchain. In other words, Bitcoin is to cryptocurrency what a specific species is to a broader biological category.n- Purpose and use cases: Bitcoin is primarily positioned as a digital store of value and a decentralized medium of exchange. Many other cryptocurrencies pursue diverse goals — from faster payments and smart contracts to privacy, interoperability, or specialized applications in domains like supply chain or decentralized finance (DeFi).n- Supply mechanics: Bitcoin has a capped supply of 21 million coins, a feature designed to mimic scarce assets like gold. Most other cryptocurrencies have different supply dynamics; some are inflationary by design, while others have hard caps or intricate emission schedules.n- Governance and development: Bitcoin’s governance is famously conservative, favoring robust security and long-term stability over rapid feature changes. Other cryptocurrencies may implement more flexible governance models or upgradable software with frequent protocol changes.n- Ecosystem and liquidity: Bitcoin generally enjoys the deepest liquidity and broadest recognition among exchanges, custodians, and institutions. However, some altcoins (alternative cryptocurrencies) have developed vibrant ecosystems with specialized use cases and community-driven development. |

| Bitcoin vs Altcoins | Altcoins (cryptocurrencies other than Bitcoin) offer features like smart contracts, DeFi, privacy-focused designs, improved speed and scalability, and cross-chain interoperability. Bitcoin is often viewed as foundational; altcoins provide varied use cases and growth opportunities. Investment decisions depend on risk tolerance, time horizon, and beliefs about technology roadmaps. |

| Use Cases and Adoption | Bitcoin as digital gold—a potential hedge and long-term store of value due to scarcity and broad acceptance. Other cryptocurrencies emphasize payments, programmable money, DeFi, or industry-specific applications (supply chain, gaming, identity). Institutional interest and retail access are expanding as custody solutions, ETPs, and regulated vehicles mature. |

| Security, Risk, and Regulation | Security relies on cryptographic foundations and secure storage; use hardware wallets and multi-signature setups. Market risk is high due to volatility; regulatory environments are evolving and can affect adoption and price dynamics. |

| Blockchain Technology Overview | Blockchains underpin both cryptocurrency and Bitcoin. Basics: a tamper-evident ledger maintained by a distributed network. Bitcoin uses proof-of-work (PoW); many other cryptocurrencies explore proof-of-stake (PoS) or other models. Fungibility and auditability: transparent ledgers enable traceability; some projects pursue privacy. Scalability and upgrades: layer solutions and protocol improvements aim to balance security, decentralization, and throughput. |

| Practical Considerations: Choosing Between Bitcoin and Other Cryptocurrencies | Time horizon: long-term store of value vs exposure to programmable money and DeFi. Diversification: core Bitcoin plus select altcoins. Security and custody: hardware wallets, backups, trusted solutions. Education and research: stay informed about roadmaps, developer communities, and regulation for Cryptocurrency vs Bitcoin and related investments. |

Summary

Conclusion: Cryptocurrency vs Bitcoin differences center on the breadth of the asset class versus the identity and role of Bitcoin within it. Bitcoin’s enduring prominence as a decentralized store of value and its first-mover advantage shape perceptions of the entire space. At the same time, the wider cryptocurrency universe continues to innovate with new use cases, faster settlement, privacy features, and cross-chain capabilities. For readers exploring this space, the framework above—understanding what cryptocurrency means, clarifying what Bitcoin is, examining Bitcoin vs altcoins dynamics, and considering use cases and risk factors—provides a practical path forward. By studying the nuances of the Cryptocurrency vs Bitcoin discussion, investors and users can make more informed decisions, recognize opportunities, and navigate market shifts with greater clarity. Remember that knowledge about blockchain technology overview, regulatory developments, and risk management is essential as you engage with Bitcoin and the broader family of cryptocurrencies.