In today’s fast-moving digital finance landscape, avoiding cryptocurrency scams is essential for anyone seeking safer participation in crypto markets today. Understanding cryptocurrency scam red flags helps you spot fraud before you invest, enabling you to act with caution rather than impulse, and to protect your capital while cultivating a disciplined, risk-aware mindset. This practical guide outlines how to avoid crypto scams by following proven crypto scam prevention tips, from assessing tokenomics to validating independent audits and governance structures, timelines, and accountability frameworks. By recognizing crypto scam schemes early, you can protect your capital and decision-making with a disciplined approach that prioritizes verification, skepticism, and documented evidence across all investments and platforms. A strong foundation in due diligence in crypto investments, ongoing risk assessment, and careful sourcing helps you navigate opportunities without sacrificing security or trust, building a repeatable due-diligence routine you can rely on for years.

Exploring the broader landscape of crypto safety involves not just spotting classic fraud signals but adopting a proactive risk-management mindset. Think of red flags as early warning signs—signals about governance, transparency, and real-world utility—that help investors separate credible projects from hype. LSI-inspired phrasing uses related terms such as tokenomics integrity, verifiable audits, on-chain transparency, and credible team verification to maintain contextual relevance while avoiding repetition. By framing due diligence in crypto investments as an ongoing, evidence-based habit rather than a one-off checklist, readers can build confidence and resilience against emerging scams. Ultimately, a security-conscious approach combines technical scrutiny with prudent behavior, guiding choices that align with long-term value creation and community trust.

avoiding cryptocurrency scams: red flags, due diligence, and practical safeguards

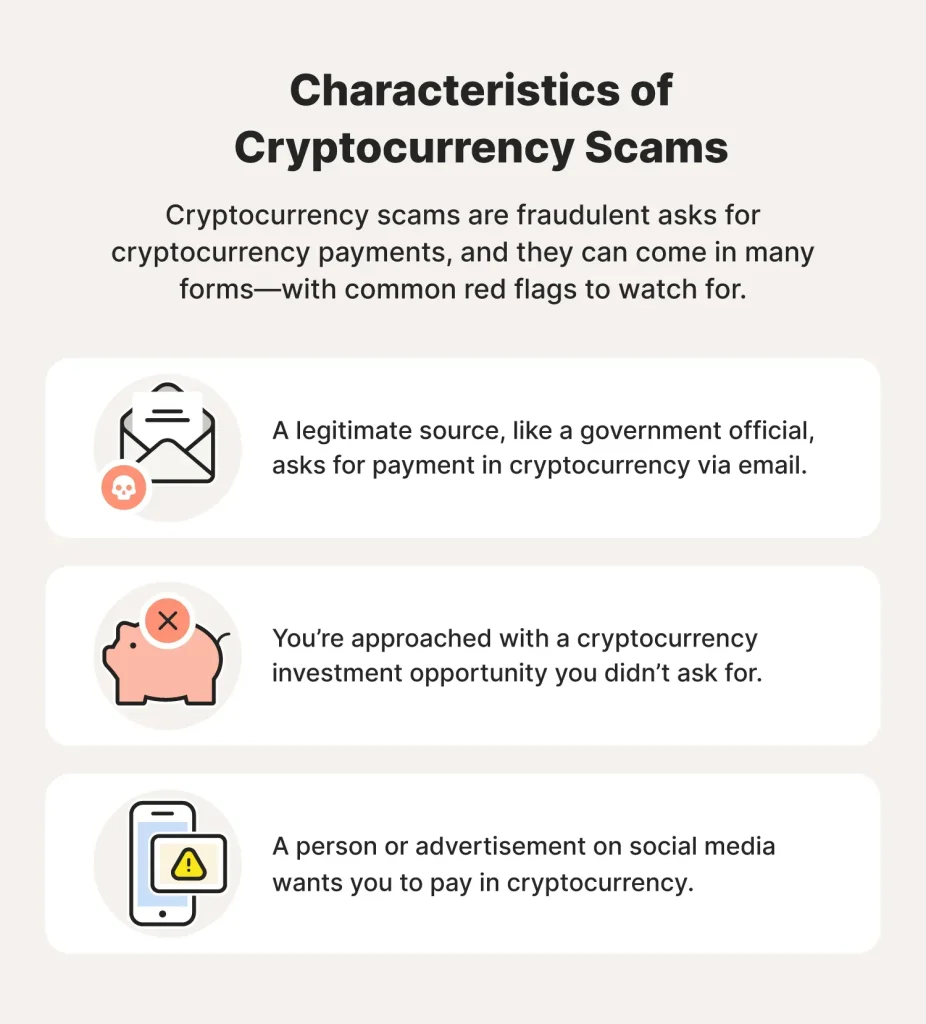

In the realm of digital assets, avoiding cryptocurrency scams begins with a trained eye for red flags and a disciplined evaluation process. Learn to spot indicators like promises of guaranteed returns, aggressive time pressure, anonymous teams, vague whitepapers, and dubious tokenomics. Recognizing cryptocurrency scam red flags early helps you pause before investing and reduces the likelihood of impulsive decisions driven by fear of missing out. By grounding your approach in careful verification and risk assessment, you improve your odds of choosing legitimate opportunities and avoiding losses. This framework also helps you understand how to avoid crypto scams in real-world scenarios.

To implement effective crypto scam prevention tips, prioritize thorough due diligence in crypto investments. Verify the project’s tokenomics, governance model, and security posture, check for independent audits, and confirm information across multiple reputable sources. Use reputable platforms and wallets, enable strong personal security practices, and adopt a stepwise investment plan that emphasizes research over hype. When you couple due diligence with prudent position sizing and a documented decision process, you build resilience against scams and strengthen long‑term outcomes.

recognizing crypto scam schemes: common patterns and safe investment practices

Recognizing crypto scam schemes means understanding the pattern of how scams operate—from fake ICOs and rug pulls to phishing and impersonation. Investors should beware of projects with opaque teams, suspicious tokenomics, and a lack of verifiable audits. Phishing attempts often masquerade as legitimate exchanges or wallets, prompting you to reveal sensitive data. By mapping these tactics to concrete warning signs, you can slow your decision-making and confirm facts before committing capital.

Adopting sound safe investment practices translates into actionable steps: start with small allocations, diversify across assets, and rely on trusted infrastructure such as regulated exchanges and hardware wallets for storage. Supplement reliance on marketing with independent analyses, on‑chain data verification, and community‑driven risk disclosures. These steps align with how to avoid crypto scams and reflect crypto scam prevention tips, while reinforcing due diligence in crypto investments as a continuous habit.

Frequently Asked Questions

What are the cryptocurrency scam red flags to watch for when practicing avoiding cryptocurrency scams?

Key crypto scam red flags to watch include unrealistic promises of high returns with little risk, pressure to act quickly, anonymous or unverifiable teams, vague or weak whitepapers, requests for private keys or seed phrases, and sudden liquidity withdrawal risks. To prevent these in the context of avoiding cryptocurrency scams, follow crypto scam prevention tips such as thorough due diligence in crypto investments, verifying the team on credible sources, evaluating tokenomics and use cases, seeking third-party audits, and using reputable exchanges and wallets. If something sounds too good to be true, it probably is, and maintaining a cautious approach is essential.

What steps in due diligence in crypto investments help with avoiding cryptocurrency scams and recognizing crypto scam schemes?

Effective due diligence for avoiding cryptocurrency scams begins with source verification and financial transparency: confirm official domains, social accounts, funding details, and tokenomics. Evaluate governance, risk disclosures, and independent audits. Look for credible security audits, real product milestones, and regulatory alignment. By applying due diligence in crypto investments and actively recognizing crypto scam schemes such as fake ICOs, phishing, rug pulls, and pump‑and‑dump patterns, you can assess security controls, on‑chain data, and claims more accurately, thereby reducing risk and improving confidence in crypto opportunities.

| Theme | Key Points | Notes / Examples |

|---|---|---|

| Understanding the threat landscape | Scams include fake ICOs, rug pulls, phishing, and impersonation; attackers exploit uncertainty and complexity of crypto projects. | Rug pulls withdraw liquidity after fundraising; phishing impersonates exchanges or wallets; fake wallets and endorsements are common tactics. |

| Red Flags and warning signs | Unrealistic returns; pressure to act quickly; anonymous or unverifiable teams; weak whitepapers; guaranteed profits; requests for private keys; unclear audits; sudden liquidity risks; heavy marketing spend | Use as a due-diligence checklist before engaging with a project. |

| Prevention tips | Do thorough due diligence; verify team; scrutinize tokenomics; assess technology and utility; check regulatory alignment; use reputable platforms; practice security hygiene; start small; seek independent opinions | Guard against social-engineering and rushing decisions; rely on verifiable sources and independent analyses. |

| Due Diligence in crypto investments | Source verification; financial transparency; governance and accountability; risk disclosures; community sentiment; ongoing process | Continuous checks over time, not a one-off exercise. |

| Recognizing scam schemes | Fake ICOs/pre-sales; phishing; rug pulls/exit scams; pump-and-dump; impersonation by trusted figures | Patterns help you anticipate and avoid common traps. |

| Practical steps for investors | Initiate slow research; talk to credible sources; validate on-chain data; diversify; maintain transaction discipline; protect digital identity; document decisions | Use checklists and records to improve decision quality and accountability. |

| Tools and resources for due diligence | On-chain explorers; independent auditors; regulatory and consumer-protection resources; security guides; educational courses | Leverage reputable tools and expert analyses to verify claims. |

| Education and community | Educating yourself; transparent updates; open critique; webinars; independent analyses | Community engagement supports risk awareness and ongoing learning. |

Summary

avoiding cryptocurrency scams is a continuous, vigilant practice of education, due diligence, and disciplined decision-making. By understanding the threat landscape, recognizing red flags, and applying practical prevention tips for avoiding cryptocurrency scams, you can reduce exposure to scams and participate more confidently in the world of digital assets. A commitment to ongoing learning and careful due diligence helps protect your capital and contributes to a healthier crypto ecosystem for everyone.