Ethereum vs Bitcoin comparison has become a central debate in the crypto space, pitting a programmable platform against a time-tested store of value. As a cryptocurrency comparison guide, this article highlights the differences between Ethereum and Bitcoin, explained through purpose, technology, and ecosystem maturity. Bitcoin vs Ethereum use cases illustrate how smart contracts and DeFi broaden what blockchain networks can enable. We also compare Ethereum gas fees vs Bitcoin transaction fees to help readers understand cost and speed in real-world scenarios. In short, understanding the differences between Ethereum and Bitcoin helps readers map their goals to the right tool.

Ethereum vs Bitcoin: A Practical Comparison of Use Cases and Technology

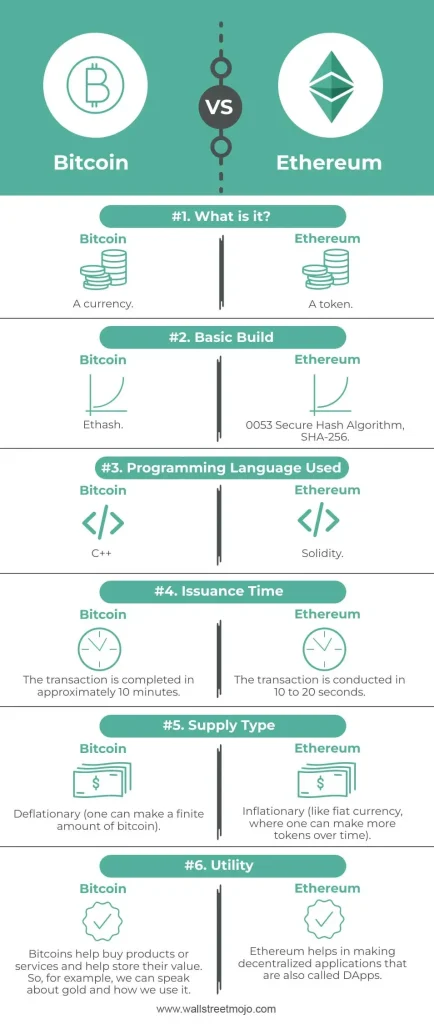

Ethereum and Bitcoin embody different visions for the future of digital money. Bitcoin is widely viewed as a resilient store of value and a cross-border settlement layer, emphasizing security, liquidity, and broad merchant acceptance. Ethereum, by contrast, is a programmable blockchain that enables smart contracts and decentralized applications, laying the groundwork for decentralized finance, non-fungible tokens, and a growing ecosystem of on-chain services. This contrast informs a practical Ethereum vs Bitcoin comparison that goes beyond price and market cap, touching on long-term utility and risk profiles.

From a use-case perspective, Bitcoin often serves as a hedge and a digital asset with global reach, while Ethereum powers programmable money and automated agreements through smart contracts. This distinction is central to a cryptocurrency comparison guide that helps readers map their goals—whether it’s simple value transfer, DeFi participation, or building on a blockchain. Understanding the Ethereum vs Bitcoin use cases framework clarifies where each asset adds value within a diversified portfolio.

differences between Ethereum and Bitcoin: Fees, Security, and Tokenomics

Tokenomics and issuance differences shape how each network evolves over time. Bitcoin operates with a capped supply of 21 million coins and a predictable issuance path that influences scarcity and long-term value. Ethereum, meanwhile, uses a more dynamic economic model that includes issuance controls and periodic burn mechanisms tied to network activity, which can influence the supply side in different market conditions. These differences between Ethereum and Bitcoin influence investor outlooks, mining or staking incentives, and long-horizon planning.

Security, governance, and risk management differ as networks transition. Bitcoin’s long track record and proof-of-work security contrast with Ethereum’s shift to proof-of-stake and a robust validator ecosystem, bringing new governance dynamics and upgrade paths. For investors and developers, this means evaluating Ethereum gas fees vs Bitcoin transaction fees in practical terms, and considering how layer-2 scaling, security audits, and bug bounty programs affect risk. In the broader context, this analysis supports a cryptocurrency comparison guide that helps stakeholders balance exposure to both assets and align with their risk tolerance and strategic goals.

Frequently Asked Questions

What are the differences between Ethereum and Bitcoin, and what does the Ethereum vs Bitcoin comparison reveal about their roles and use cases?

Bitcoin and Ethereum were built with different goals. Bitcoin is a digital cash system with a capped supply of 21 million and a proof-of-work security model, designed for simple value transfer and a store of value. Ethereum is a programmable blockchain that supports smart contracts and decentralized apps, with no fixed supply and a shift to proof-of-stake to improve scalability and energy use. These core differences shape their use cases: Bitcoin as digital gold and a cross-border settlement layer; Ethereum as a platform for DeFi, NFTs, and automated agreements. In a Ethereum vs Bitcoin comparison and within the broader cryptocurrency comparison guide, both can complement a crypto strategy: Bitcoin for stability and liquidity, Ethereum for growth through on-chain applications. When planning a portfolio, consider your time horizon, risk tolerance, and appetite for developer ecosystems.

How do Ethereum gas fees vs Bitcoin transaction fees affect costs and user experience across typical transfers and smart contract interactions?

Ethereum gas fees vary with contract complexity and network demand; during peak times, gas prices rise and transactions may take longer, though Layer 2s and rollups help reduce congestion. Bitcoin fees are more stable for simple transfers but can rise with congestion; Bitcoin prioritizes security and reliability over throughput, so large or time-insensitive transfers often work well with cost predictability. For everyday use, consider timing, off-chain solutions, or batching, and always factor in potential fees when planning trades or interactions with smart contracts in the Ethereum ecosystem. As the networks evolve, upgrades and scaling solutions aim to make both cheaper and faster.

| Topic | Ethereum | Bitcoin |

|---|---|---|

| Purpose and design | Programmable platform with smart contracts, DApps, DeFi, and NFTs; enables programmable value and applications | Digital currency focused on store of value, security, and cross-border value transfer; simple money rails |

| Supply and issuance | No fixed supply; issuance managed via protocol with burn mechanisms and variable supply dynamics | Capped at 21 million; issuance through predictable mining with halving over time |

| Consensus and security | Transitioned to proof of stake; aims for higher throughput, energy efficiency, and validator governance | Proof of work with decentralized mining; long track record and energy-intensive security; now complementing PoS trajectory on risk considerations |

| Programmability and tooling | Smart contracts enable programmable money and a broad ecosystem of DApps, DeFi, and NFTs | Limited scripting with strong emphasis on security and reliability; broad network effects but fewer programmable features |

| Use cases and applications | DeFi, NFTs, gaming, automated agreements, and on-chain applications | Value transfer, digital scarcity, cross-border payments, and as a store of value |

| Fees, speed, and scaling | Gas fees vary with demand; Layer 2 solutions and rollups improve efficiency; congestion-focused upgrades | Relatively slower/more expensive during congestion for simple transfers; scaling via off-chain/side chains; high reliability for transfers |

| Security, governance, and risk management | Smart contract risk management, validator governance, frequent upgrades; evolving security landscape | Mature security model, energy-intensive mining history; governance more centralized around miners and protocol noise; staking risk during transitions |

| Investment considerations and portfolio positioning | Exposure to growth through DeFi, DApps, and ongoing upgrades; diversification within crypto | Exposure to store of value and liquidity; core holding for risk-averse investors; hedge against traditional markets |

Summary

Conclusion: The two ecosystems complement each other and offer different rails for value transfer and programmable applications. In the Ethereum vs Bitcoin context, investors often pursue a diversified approach, balancing Bitcoin’s store of value with Ethereum’s expanding ecosystem to participate in DeFi, NFTs, and on-chain services. This descriptive summary emphasizes that choosing between them is not about ‘which is better’ but about aligning with goals, risk tolerance, and time horizon, recognizing that both play important roles in the evolving landscape of digital money.