Crypto diversified portfolio principles provide a structured way to spread risk across the crypto universe while pursuing long-term upside. An effective approach is to pair a broad portfolio with clear crypto asset allocation, balancing exposure to blue-chip coins, smart-contract platforms, and emerging tokens. This approach fosters disciplined risk controls, systematic rebalancing, and a focus on fundamentals over hype. Stablecoins can provide liquidity buffers that help smooth rebalancing during market swings. With clear goals, time horizons, and robust security, you can build a resilient framework for your digital-asset journey.

Think of this as a thoughtful digital asset mix rather than a random assortment of tokens. Rather than chasing every new project, you design a crypto investment blueprint that blends dependable assets with promising innovations while considering liquidity and your time horizon. This approach aligns with cryptocurrency investment strategies that emphasize risk awareness, diversification, and ongoing performance monitoring. By measuring correlations, maintaining a liquidity buffer, and rebalancing as markets move, you can pursue steady growth in your portfolio over time.

Crypto diversified portfolio: Core principles, asset mix, and practical steps

A crypto diversified portfolio isn’t a random grab bag of tokens; it’s a deliberate strategy to spread risk while pursuing upside across different sectors in the crypto market. Framing the idea through crypto asset allocation helps you decide how much capital to place in blue-chip coins, smart contract platforms, layer-1 protocols, DeFi, and NFT ecosystems, reducing single-asset risk.

With this approach, start by a stable core and then add satellite bets across sectors. Maintain a balance between stablecoins for liquidity and growth-oriented altcoins, using stablecoins and altcoins diversification as a practical guardrail. Rebalancing over time keeps the diversified crypto portfolio aligned with your goals, time horizon, and risk tolerance.

Crypto asset allocation: Cryptocurrency investment strategies and risk controls

Effective crypto asset allocation hinges on a solid risk management in crypto framework. Define your maximum drawdown, liquidity needs, and position sizes, then consider how asset correlations impact overall risk. This foundation helps you avoid overexposure to a single narrative and supports steadier performance.

Implement cryptocurrency investment strategies like core-satellite allocations, time-horizon aware planning, and disciplined rebalancing. Regularly adjust exposures, use dollar-cost averaging, and maintain a balanced mix of stablecoins and altcoins diversification alongside high-conviction core assets. A structured approach reduces emotion-based bets and supports long-term growth.

Frequently Asked Questions

What is a diversified crypto portfolio and how does crypto asset allocation manage risk?

A diversified crypto portfolio spreads exposure across different asset types to reduce single‑asset risk and weather volatility. Crypto asset allocation is the deliberate weighting of assets—core holdings like BTC and ETH, diversified layer‑1s and smart contract platforms, DeFi and NFT tokens, and a buffer of stablecoins for liquidity—to balance risk and potential return. Core principles include setting goals, defining a risk framework, mixing assets for growth and stability, maintaining liquidity, and rebalancing as markets move. Building blocks typically involve a stable core, broad altcoin exposure, and selective growth opportunities, all guided by correlations and liquidity to protect the portfolio during downturns.

What steps should I take to build and maintain a diversified crypto portfolio with effective risk management in crypto?

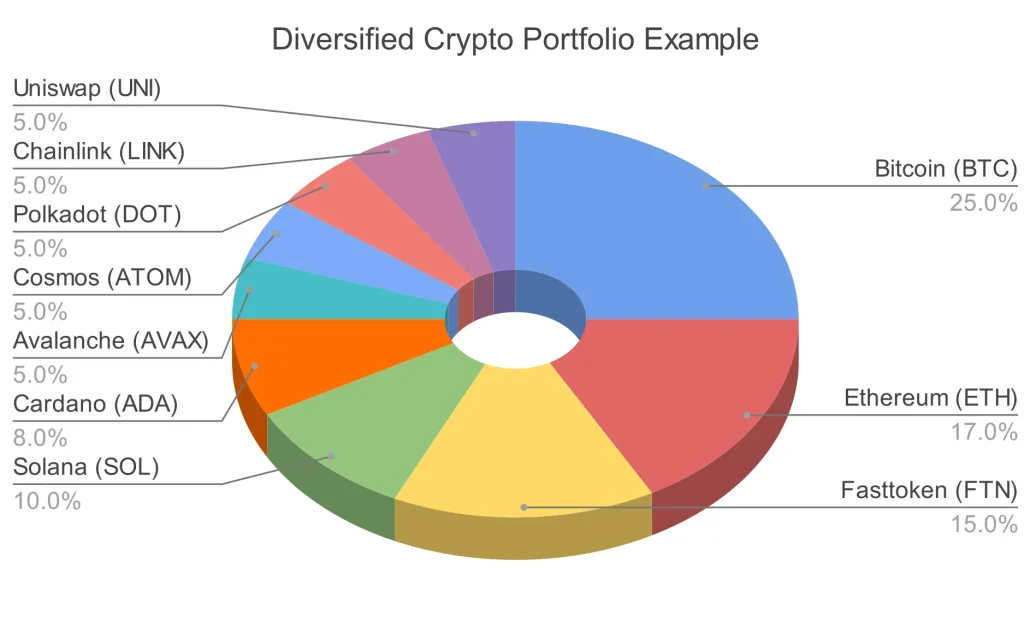

Start by defining your risk tolerance and time horizon, then set a simple target allocation (for example, a core 40% BTC/ETH, 25% diversified layer‑1s, 15% DeFi/NFT tokens, 10% stablecoins, and 10% selective small caps). Ensure secure storage and custody, use reliable wallets, and enable strong security practices. Select assets with real use cases and solid development, diversifying across sectors to reduce reliance on any single trend. Implement a staged entry plan with dollar‑cost averaging to mitigate timing risk, and monitor performance, volatility, and correlations with quarterly reviews. Rebalance with purpose when an asset drifts from target allocations, trimming or adding to areas to maintain your crypto asset allocation. Avoid common mistakes like overconcentration, illiquidity, and ignoring fees or taxes. Focus on risk management in crypto and stablecoins and altcoins diversification to preserve liquidity and resilience while pursuing growth.

| Section | Key Points |

|---|---|

| What is a diversified crypto portfolio? |

|

| Core principles of diversification in crypto |

|

| Building blocks of a crypto diversified portfolio |

|

| Crypto asset allocation strategies for beginners |

|

| Practical steps to build your crypto diversified portfolio |

|

| Common mistakes to avoid |

|

| Putting it all together: the journey toward a resilient crypto diversified portfolio | Building a diversified crypto portfolio is a continuous process, not a one-off hit list. Start with a solid core, gradually add complementary assets, and stay disciplined with risk management and rebalancing. The result is not guaranteed profits but a framework that reduces heart-stopping drawdowns and improves your odds of sustainable growth over time. As you gain experience, you’ll refine your asset allocation, incorporate broader market insights, and develop a confident approach to cryptocurrency investments that aligns with your broader financial plan. |

Summary

Crypto diversified portfolio strategies emphasize thoughtful diversification, sensible asset allocation, and steady risk management. A well-constructed approach blends core assets with selective satellites across blue-chip coins, smart contract platforms, DeFi, NFT ecosystems, and liquidity tools to weather volatility and pursue sustainable growth. Start with a solid core, plan gradual entries, and rebalance regularly to adapt to changing market conditions. This disciplined framework helps manage risk, reduce drawdowns, and capture long-term upside while aligning with your personal goals and time horizon.