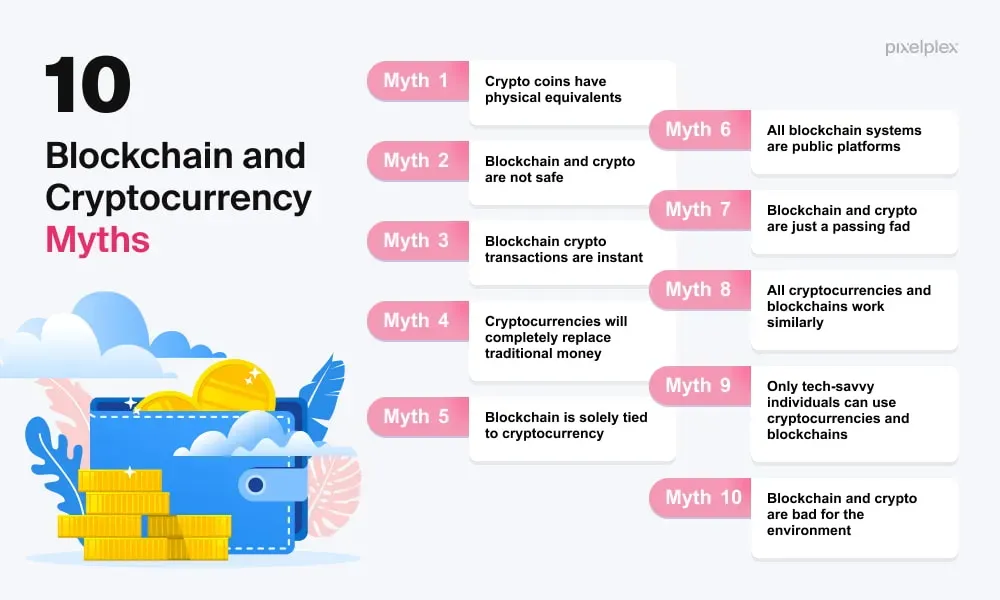

Cryptocurrency myths have circulated since the early days of digital currencies, shaping how newcomers and seasoned investors view the space. To cut through the noise, this piece leans on Cryptocurrency myths debunked and cryptocurrency facts vs fiction to separate hype from evidence. First, it clarifies what cryptocurrency is and how cryptocurrency works, so readers can assess claims with a solid baseline. Next, we tackle crypto investing myths by highlighting risk, diversification, and realistic expectations. Finally, a clear explanation of blockchain myths explained helps demystify the technology behind digital assets.

Viewed from a broader lens, digital assets misconceptions reveal the practical uses of distributed ledger technology beyond price movement. Consider terms like blockchain myths explained, token economies, DeFi applications, and crypto market narratives to capture the spectrum of reality versus hype. These reframed ideas foster a more nuanced understanding of what crypto can do for payments, contracts, and digital identity rather than mere speculation.

Cryptocurrency myths: Debunked, cryptocurrency facts vs fiction, and how cryptocurrency works

Cryptocurrency myths have shaped expectations and hesitation alike, but the reality is more nuanced. In the ongoing discussion of cryptocurrency myths debunked, it helps to anchor beliefs in how the technology operates: a distributed, cryptographically secured ledger, private keys, and consensus mechanisms that validate transactions. Understanding how cryptocurrency works clarifies what drives moves in price, what creates security, and why some projects succeed where others struggle. This grounding reduces reliance on hype and increases confidence in careful, evidence-based decision-making.

Exploring cryptocurrency facts vs fiction reveals a landscape with genuine utility alongside risk. Blockchain myths explained show that blockchain technology has applications beyond just currency—decentralized finance, programmable contracts, and transparent record-keeping are real use cases. By separating crypto investing myths from observable fundamentals, readers can appreciate the need for diversification, risk assessment, and long-term perspective rather than expecting instant windfalls. In this frame, the focus remains on verifiable features, use cases, and technology rather than sensational headlines.

Blockchain myths explained and crypto investing myths: Real-world value beyond price

Blockchain myths explained helps readers see the broader potential of distributed ledger technology. Beyond digital money, blockchain can improve supply-chain traceability, secure digital identities, and auditable governance across industries. Recognizing these applications counters the idea that blockchain is limited to crypto speculation and highlights why developers and institutions invest in these protocols. Alongside this, crypto investing myths emphasize that returns come from fundamentals—not from rumor—through thoughtful evaluation of technology, use case viability, and community support.

As adoption grows, regulatory realities and practical risk management become integral to the story. The real-world value comes when you pair secure custody practices, compliant platforms, and transparent project roadmaps with a broad understanding of market dynamics. Blockchain myths explained thus informs a prudent approach to investing: differentiate coins by purpose, assess developer activity and governance, and balance potential upside with risk tolerance. By focusing on real-world use cases and responsible investment practices, readers can move from speculation toward informed engagement with the crypto ecosystem.

Frequently Asked Questions

Cryptocurrency myths debunked: how does cryptocurrency work in practice, and why do crypto investing myths about quick riches persist?

Cryptocurrency works on blockchain networks where private keys control ownership and wallets enable transfers. Transactions are grouped into blocks and confirmed by a consensus mechanism (such as proof of work or proof of stake) before being added to a public ledger. This shows why the crypto investing myths about guaranteed riches are misleading: crypto is high‑risk and highly volatile, with outcomes shaped by market sentiment, regulation, and macro factors. A disciplined approach—DYOR, diversification, and a long‑term horizon—reflects the reality behind cryptocurrency myths debunked, rather than chasing hype. Understanding how cryptocurrency works helps separate facts from fiction and supports more informed investment decisions.

Cryptocurrency facts vs fiction: are cryptocurrencies illegal or unregulated everywhere, and what does blockchain myths explained reveal about the regulatory landscape?

Regulation varies by country; crypto is not illegal in most jurisdictions and is often regulated for consumer protection, AML/KYC, and tax reporting. Authorities may require exchanges to obtain licenses and investors to report holdings; governance continues to balance innovation with security. This aligns with the cryptocurrency facts vs fiction discussion and blockchain myths explained: legality is not uniform, and staying informed about local rules helps distinguish myth from reality. For investors and users, understanding the regulatory landscape is essential for compliant, responsible participation.

| Key Point | Summary / Focus | Reality / Facts | Practical Takeaway |

|---|---|---|---|

| Myth 1: Crypto is a guaranteed path to riches and fast money | Investing in crypto automatically yields quick profits | Price swings are dramatic; crypto is high risk and not guaranteed to make money. Long-term discipline matters. | Base decisions on risk assessment, diversification, and a clear, long‑term plan. |

| Myth 2: Crypto is illegal or unregulated everywhere | Crypto is universally illegal | Regulation varies by jurisdiction; many places regulate for consumer protection, AML/KYC, and taxes. Laws evolve. | Stay informed about local laws, exchange compliance, and policy changes; ensure compliant platforms. |

| Myth 3: Bitcoin and other cryptos are primarily used for wrongdoing | Crypto is mainly for illicit activity | Most crypto activity is legitimate; crypto enables long‑term investment, cross‑border payments, remittances, and DeFi. | Recognize legitimate use cases and rely on compliant, secure practices. |

| Myth 4: Crypto is inherently unsafe or insecure | Crypto is inherently unsafe | Security depends on custody and private keys; risk is mitigated by hardware wallets, multisig, and best practices. | Adopt secure storage, trusted platforms, and robust authentication; avoid insecure setups. |

| Myth 5: Crypto is only about price speculation and has no real-world utility | Crypto has no real-world utility | Crypto enables payments, DeFi, NFTs, and smart contracts; real systems are evolving. | Evaluate use cases and fundamentals beyond price; look for tangible applications. |

| Myth 6: All cryptocurrencies are the same | Cryptocurrencies are otherwise identical | Different goals and tech (store of value, fast payments, smart contracts, etc.). Governance and economics vary. | Differentiate assets by technology, use case, and community; perform fundamental checks. |

| Myth 7: Blockchain is only about cryptocurrency and has no other uses | Blockchain has limited uses beyond crypto | Blockchain enables supply chains, digital identities, governance, and immutable record‑keeping. | Explore non-financial blockchain applications and potential efficiencies in various sectors. |

| Myth 8: Crypto investments are a guaranteed hedge against traditional markets | Crypto reliably hedges traditional markets | Crypto shows complex and often volatile correlations; diversification and risk management are essential. | Test crypto exposure against risk tolerance; practice diversification and defined exit strategies. |

| How cryptocurrency works | Overview of mechanics: blockchain, private keys, blocks, and consensus (PoW/PoS); Smart contracts and DeFi. | These mechanisms secure networks, enable programmable money, and underpin real-world use cases; volatility and regulation remain challenges. | Understand core concepts to assess claims in Cryptocurrency myths and evaluate crypto assets. |

| Practical guidance: how to approach cryptocurrency myths in real life | DYOR; separate fundamentals from short‑term moves; use reputable platforms; diversify; invest what you can lose; monitor regulation | Successful approach combines due diligence, risk management, and compliant, reliable infrastructure. | Follow a disciplined, informed process when evaluating Cryptocurrency myths and crypto investments. |

| Conclusion | Summary of the myths vs. reality in crypto | Cryptocurrency myths persist, but facts show a nuanced space with opportunity and risk. | Adopt informed thinking, continuous learning, and prudent risk management to navigate Cryptocurrency myths and the broader crypto landscape. |