Cryptocurrency portfolio diversification is not a gimmick; it’s a disciplined approach to weather volatility while pursuing upside for patient investors who want clarity amid uncertainty. In a market known for dramatic price swings and rapid shifts in sentiment, a well-structured crypto portfolio diversification plan helps reduce stress, preserve capital during downturns, and position you for steadier, long-term performance. This practical guide outlines diversification strategies for cryptocurrency, core asset allocations, and risk management with cryptocurrency that translate into repeatable results while remaining adaptable to evolving technology, regulatory landscapes, and policy changes. By combining blue-chip holdings with selective growth assets and stablecoins, you can achieve blockchain asset diversification that preserves liquidity, reduces correlation risks, and keeps costs manageable as markets ebb and flow across global markets. You’ll also learn to measure risk, implement dynamic rebalancing, use cryptocurrency investment strategies that fit your horizon, and apply tax-aware thinking to maintain a resilient posture across cycles and opportunities.

If you prefer different terminology, this topic can be framed as digital asset allocation across multiple crypto and traditional assets to smooth volatility and improve risk-adjusted returns. A risk-aware crypto investing mindset emphasizes measured exposure management, diversified layer-1 and DeFi exposure, and liquidity planning to weather downturns. By adopting cryptocurrency exposure management, investors can balance potential upside with downside protection, leveraging stablecoins, hedging where appropriate, and cross-asset diversification. In practice, the goal is to create a resilient allocation that aligns with your time horizon, financial goals, and tax considerations while staying adaptable to innovation within the broader blockchain ecosystem.

Cryptocurrency portfolio diversification: Core principles and asset allocations

Effective Cryptocurrency portfolio diversification is more than spreading bets; it is a disciplined framework that blends across-asset diversification with within-crypto diversification to weather volatility and pursue durable upside. By combining exposure to established blue chip holdings like Bitcoin and Ethereum with selective growth opportunities, investors reduce idiosyncratic risk and create a more predictable risk profile.

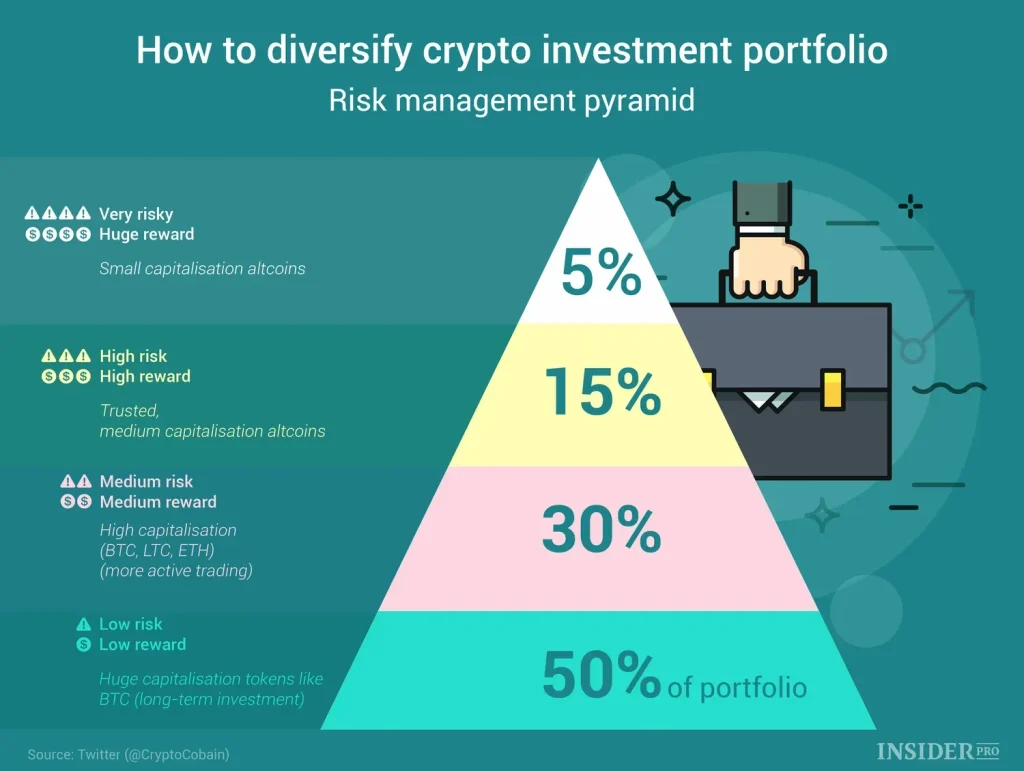

For example, a practical allocation framework might place 40-60 percent in core crypto, 15-25 percent in growth assets, 10-15 percent in stability and liquidity, and 10-20 percent in non-crypto diversification. This approach embodies diversification strategies for cryptocurrency by maintaining enough conviction in flagship assets while reserving capital across sector-specific plays, DeFi, layer-2 networks, and stablecoins to smooth risk. It also aligns with blockchain asset diversification by balancing non-crypto assets.

Diversification strategies for cryptocurrency: Practical approaches to risk and growth

Diversification strategies for cryptocurrency emphasize cross-sector exposure within the crypto ecosystem, stablecoins for liquidity, and disciplined risk budgeting to guard against drawdowns. Whether you are pursuing Bitcoin-centric exposure or exploring DeFi, privacy coins, or layer-2 solutions, spreading risk across technology stacks reduces concentration risk and supports more robust risk management with cryptocurrency.

To implement these strategies, set rules for rebalancing such as quarterly or semi-annual, run scenario tests for shocks, and use portfolio trackers and automated rebalancing tools. Pair these with tax-aware planning and solid custody practices to sustain long-term cryptocurrency investment strategies and blockchain asset diversification across markets.

Frequently Asked Questions

How does Cryptocurrency portfolio diversification help manage risk in volatile crypto markets?

Cryptocurrency portfolio diversification reduces risk by spreading exposure across asset classes and crypto sectors. It combines across-asset diversification (crypto, traditional assets) with within-crypto diversification (blue-chip coins, mid-cap tokens, DeFi, stablecoins) and dynamic rebalancing to lock in gains and limit losses. Core holdings like Bitcoin and Ethereum provide stability and liquidity, while growth assets offer upside. Stablecoins improve liquidity for rebalancing, and disciplined rebalancing and risk controls support risk management with cryptocurrency.

What diversification strategies for cryptocurrency best support risk management with cryptocurrency?

Diversification strategies for cryptocurrency to optimize risk management with cryptocurrency include setting clear asset targets based on your risk tolerance, diversifying within crypto (blue-chip coins, layer-2s, DeFi tokens, stablecoins), and adding cross-asset exposure to traditional assets. Use dollar-cost averaging and systematic rebalancing to maintain target allocations and smooth volatility. Consider hedging tools where appropriate, mindful of costs and complexity. Also integrate tax-aware planning and risk analytics to continuously refine your strategy.

| Aspect | Key Points |

|---|---|

| Purpose | Crypto portfolio diversification is a disciplined approach to weather volatility while pursuing upside. |

| Why diversification matters | Crypto is highly volatile; diversification smooths returns and aligns with risk tolerance and long-term goals. |

| Foundations | Across-asset diversification; Within-crypto diversification; Dynamic rebalancing to adapt to market shifts. |

| Key concepts | Three ideas: across-asset diversification, within-crypto diversification, and dynamic rebalancing. |

| Key components of a diversified allocation | Core holdings (blue-chip), Growth assets (mid/small-cap), Stability and liquidity (stablecoins), Hedging tools, Cross-asset diversification. |

| Core holdings | Bitcoin and Ethereum anchor liquidity and exposure. |

| Growth assets | Mid-cap/altcoins with compelling narratives and solid teams. |

| Stability and liquidity | Stablecoins provide cash-like liquidity for rebalancing and opportunistic deployment. |

| Hedging and risk management | Futures, options, or hedges when available; mindful of costs and complexity. |

| Cross-asset diversification | Incorporate traditional assets to balance crypto volatility. |

| Allocation framework | Typical ranges: Core 40-60%; Growth 15-25%; Hedging 10-15%; Non-crypto 10-20%. |

| Strategies | DCA, systematic rebalancing, cross-sector crypto, stablecoins, position sizing, scenario testing, tax-aware planning. |

| Tools to implement | Portfolio trackers, automated rebalancing, tax/compliance software, risk analytics, and security practices. |

| Risk considerations | Volatility, liquidity constraints, regulatory/custody risk, and behavioral biases; maintain emergency cash. |

| Practical steps | Define risk tolerance; set targets; build crypto ladder; choose tools; rebalance regularly; document process. |

| Common mistakes | Over-concentration, ignoring liquidity, neglecting risk controls, underestimating taxes. |

| Case study | Hypothetical diversified crypto portfolio with allocations and rebalancing example. |

Summary

Cryptocurrency portfolio diversification is a practical, disciplined approach to balancing growth potential with risk. By combining across-asset diversification, within-crypto diversification, and dynamic rebalancing, you can build a resilient crypto portfolio that withstands volatility across market cycles. The framework described here—core holdings, growth assets, liquidity, hedging tools, and non-crypto diversification—offers a repeatable process aligned with your risk tolerance and time horizon. Implementing DCA, systematic rebalancing, tax-aware planning, and robust risk controls helps preserve capital while preserving upside potential. As markets evolve, stay curious, monitor results, and adjust allocations to reflect changing conditions and goals.