A diversified cryptocurrency portfolio is a practical framework for navigating a fast-moving market and managing uncertainty, turning volatility into an opportunity rather than a shock to your plans. By spreading exposure across blue-chip coins like Bitcoin and Ethereum, growth-oriented altcoins, DeFi tokens, and stablecoins in crypto portfolios, you can reduce idiosyncratic risk while staying exposed to multiple catalysts. This approach supports cryptocurrency diversification strategies that balance potential upside with downside protection and aligns with a clear crypto asset allocation, so you are not guessing at sector bets but following a deliberate plan. A disciplined rebalancing plan, supported by robust risk management in cryptocurrency principles, helps your portfolio adjust to new developments, shifting correlations, and evolving regulatory landscapes without succumbing to market fads. With a thoughtful bitcoin and altcoins portfolio balance, you can pursue growth while preserving liquidity and risk controls, ensuring resilience across cycles and aligning with your long-term financial goals.

In practical terms, this same concept can be described as a balanced crypto asset mix designed around core holdings, complementary growth tokens, and liquidity controls. From an LSI perspective, you are looking at a diversified asset class blend, a strategic allocation across blue chips, scalable networks, DeFi and governance plays, and smart use of stablecoins for downturn buffers. Rather than chasing every new token, you emphasize a risk-adjusted crypto portfolio framework that considers correlations, drawdown tolerance, and opportunities across different tech stacks. Liquidity management through cash-like stablecoins and other cash equivalents helps prevent forced sales during volatility, while ongoing monitoring ensures the plan stays aligned with evolving market dynamics. By focusing on terms like asset mix optimization, sector balance, and long-horizon growth alongside risk controls, you create a descriptive blueprint for crypto investing that supports sustainable returns.

Building a diversified cryptocurrency portfolio: Core principles of crypto asset allocation and risk management

A diversified cryptocurrency portfolio begins with clarity about your goals, time horizon, and risk tolerance. It blends blue-chip assets like Bitcoin and Ethereum with growth-oriented altcoins, DeFi tokens, and governance projects to capture multiple narratives while reducing single-project risk. This approach aligns with cryptocurrency diversification strategies that emphasize spreading exposure across asset classes to smooth volatility and improve resilience against sector-specific shocks. Incorporating stablecoins and cash equivalents also improves liquidity, enabling timely rebalancing during drawdowns.

Next, translate goals into a formal crypto asset allocation framework: define target weights, monitor correlations, and rebalance to maintain the intended mix. A robust risk management in cryptocurrency plan considers volatility, drawdown limits, and potential regulatory changes that could affect certain assets. By pairing core holdings (Bitcoin and Ethereum) with complementary growth assets and defensive liquidity, you create a diversified cryptocurrency portfolio designed for long-term resilience and ongoing upside, rather than chasing every hot token.

Optimizing crypto asset allocation with diversification strategies and stablecoins in crypto portfolios

Stablecoins in crypto portfolios provide liquidity buffers that smooth volatility and enable opportunistic rebalancing without forced selling. Pairing stablecoins with Bitcoin, Ethereum, and select altcoins supports a balanced mix that withstands extended downturns. This aligns with diversification strategies that prioritize different risk drivers and emphasizes the role of risk management in cryptocurrency by setting exposure caps and defined rebalancing triggers, ensuring liquidity is always available when risk parameters change.

To achieve the bitcoin and altcoins portfolio balance, you combine a core BTC/ETH backbone with growth-oriented tokens and sector-specific bets, maintaining diversification while avoiding overconcentration. Regular reevaluation of correlations and market regimes helps you tune the balance between store-of-value assets and higher-growth opportunities. This practical approach mirrors the broader theme of cryptocurrency diversification strategies and supports a disciplined rebalancing process to protect downside while pursuing asymmetric upside.

Frequently Asked Questions

How can a diversified cryptocurrency portfolio implement cryptocurrency diversification strategies to reduce risk while pursuing growth?

A diversified cryptocurrency portfolio reduces unsystematic risk by combining blue-chip assets, growth-oriented altcoins, DeFi tokens, and stablecoins for liquidity. Using cryptocurrency diversification strategies helps balance drivers across assets, so downturns in one sector are cushioned by others. Incorporate risk management in cryptocurrency by setting rebalancing rules, monitoring volatility and correlations, and maintaining liquidity buffers. A disciplined approach ensures the diversified cryptocurrency portfolio remains aligned with your goals.

What role do stablecoins in crypto portfolios play in a diversified cryptocurrency portfolio, and how should you structure crypto asset allocation to balance Bitcoin and altcoins?

Stablecoins in crypto portfolios provide liquidity and a cushion for rebalancing, helping a diversified cryptocurrency portfolio weather volatility. They serve as a cash-like reserve that supports timely deployment into growth assets or during drawdowns, without forcing asset sales. For crypto asset allocation, start with core holdings in Bitcoin and Ethereum, add growth-oriented altcoins, and allocate a portion to stablecoins to maintain liquidity and reduce risk. Regular rebalancing and monitoring correlations help preserve the Bitcoin and altcoins portfolio balance over time.

| Key Point | Summary |

|---|---|

| Diversification purpose | Spreads risk across token types and use cases; reduces impact of any single project’s misstep; enables participation in multiple growth narratives; requires purposeful allocation, ongoing monitoring, and disciplined rebalancing. |

| Diversification vs speculative mix | Combines flagship assets with carefully chosen alternatives; includes stablecoins for liquidity and risk management; not about owning many tokens, but selecting asset types with different drivers. |

| Core concepts of diversification | Reduces unsystematic risk by spreading across assets with different drivers; mixes blue-chip, layer-2, DeFi/governance, and stablecoins; includes a risk management framework for volatility, correlation, and downside protection. |

| Asset classes | Blue-chip cryptocurrencies ( BTC/ETH ) as core; growth-oriented altcoins; DeFi/governance tokens; stablecoins for liquidity; awareness of supply and risk considerations. |

| Role of correlations | Diversification works best when assets don’t move in lockstep; correlations can rise in downturns; use a mix of assets with different drivers to cushion drawdowns and preserve upside. |

| How to structure the portfolio | Define risk tolerance and time horizon; establish core holdings (e.g., BTC/ETH); add diversification layers (growth altcoins, DeFi, infrastructure); include liquidity components (stablecoins); implement risk management thresholds. |

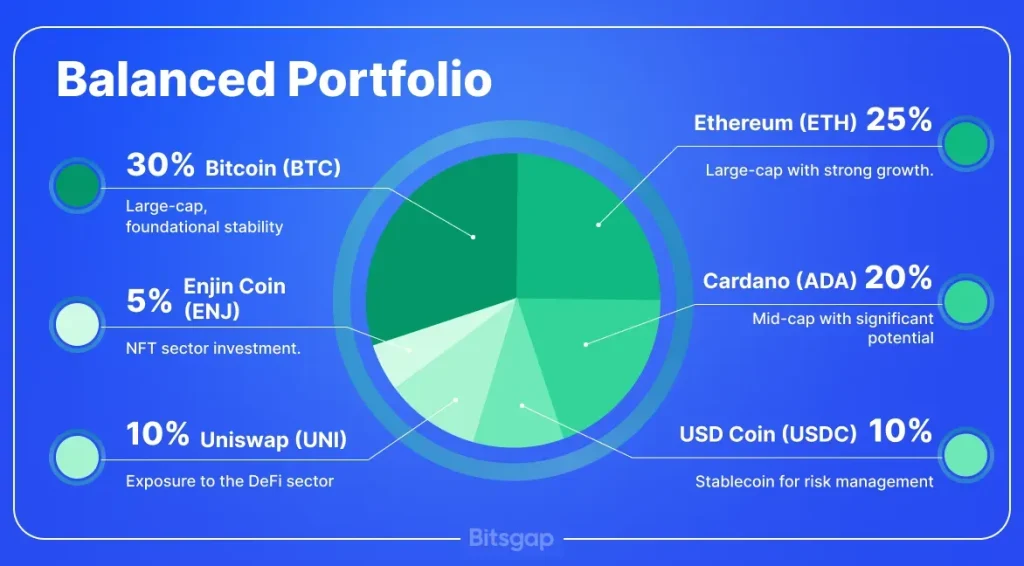

| Asset allocation example | Illustrative distribution: 40-50% Bitcoin and Ethereum; 20-30% growth-oriented Altcoins; 10-15% DeFi/governance; 10-15% stablecoins. |

| Risk management & discipline | Define rebalancing rules; monitor correlations and volatility; manage liquidity risk; consider regulatory and security factors. |

| Tax implications & costs | Consider jurisdiction tax implications; account for transaction costs (gas, exchange, custody) in the strategy; factor these into after-tax, after-fee results. |

| Tools to support diversified strategy | Portfolio trackers, price feeds, tax software; education and research to inform allocation decisions and monitor diversification benefits. |

| Long-term perspective | Markets evolve quickly; maintain a long-term view, stay disciplined with rebalancing, and continually learn to adapt allocations as circumstances change. |

Summary

A diversified cryptocurrency portfolio is a practical, repeatable approach to crypto investing. By balancing core assets with growth-oriented tokens, DeFi/governance exposure, and liquidity buffers, you position yourself to navigate volatility while pursuing multiple growth narratives. This long-term, disciplined approach emphasizes risk management, ongoing learning, and regular rebalancing to adapt to evolving markets and technologies.