The idea of mobile payments for businesses has moved from niche to mainstream, powering everyday transactions. In today’s fast-paced economy, customers expect quick, secure, and convenient ways to pay, including contactless payments for merchants when they’re grabbing coffee or booking services. Adopting the right mobile payment solutions for businesses helps streamline checkout, improve cash flow, and compete with larger brands that already offer frictionless experiences. This guide explains what mobile payments involve, why they matter for modern commerce, and how to implement a practical, scalable strategy aligned with your goals, including digital wallets for business. By prioritizing speed, security, and a seamless customer journey, you’ll strengthen trust with PCI compliance for mobile payments and optimize payment processing for small business.

From a broader perspective, the shift centers on accepting payments through mobile devices—whether via tap-to-pay, QR codes, or wallet apps—across physical and digital touchpoints. Merchants can leverage digital wallets for business and contactless options to speed transactions, while ensuring reliable payment processing for small business needs. A strong security foundation, PCI compliance for mobile payments, and layered fraud protection help build trust as these digital channels mature. The overarching aim is a seamless, data-driven checkout that unifies online, in-store, and on-the-go experiences.

Mobile Payments for Businesses: Accelerating Checkout and Elevating Customer Experience

Mobile payments for businesses are no longer a niche option; they power everyday purchases by enabling fast, secure, and frictionless checkout across storefronts, apps, and pop-up events. When you adopt mobile payments for businesses, you tap into a broader ecosystem of mobile payment solutions for businesses that support NFC tap-to-pay, QR-code checkout, and digital wallets for business. Customers value speed and simplicity, and merchants can meet those expectations with contactless payments for merchants and integrated wallets that streamline the purchase.

Implementing a practical rollout begins with choosing the right hardware and software foundations: a compatible payment acceptor, reliable software for processing, and analytics that show you where to optimize. A flexible setup—think smartphones paired with mobile card readers, QR-based checkouts, and offline mode for connectivity gaps—lets you serve a cafe, a service van, or a curbside pickup with the same core system. This is where digital wallets for business and card-present options converge to create a fast, secure checkout that customers barely notice.

Beyond speed, a successful mobile payments strategy improves reconciliation, inventory accuracy, and customer insights. By tracking payment processing for small business across channels, you can tailor promotions, measure conversion in real time, and refine your pricing strategy. Security and trust remain critical, so you’ll want to ensure PCI compliance for mobile payments, tokenization of card data, and robust fraud prevention are built into your chosen platform.

Strategies for a Scalable Mobile Payment Program: Security, Compliance, and Growth Analytics

To scale a mobile payments program, start with a clear plan that aligns with your business model and customer journey. Evaluate providers based on total cost of ownership, speed of settlement, and compatibility with your POS and back-office systems. Emphasize a rollout that begins with a single location or sales channel and then expands—this disciplined approach lets you test mobile payment solutions for businesses in a controlled environment while gathering actionable data and feedback.

Security, compliance, and governance are foundational. Prioritize PCI compliance for mobile payments, ensure data is tokenized and encrypted, and establish a routine for vulnerability scans and access controls. Look for features like fraud prevention, remote processing, and clear responsibility for PCI scope between processor, software vendor, and your business. This reduces risk and communicates trust to customers who expect privacy as part of a modern payment experience, including those using contactless payments for merchants.

Finally, leverage data to drive continuous improvement. Real-time dashboards, receipts, and analytics help you optimize promotions, forecast demand, and tailor marketing to different segments. A scalable program should offer flexible reporting, easy integration with accounting, and the ability to test new payment methods—such as QR payments or cross-border options—without disrupting core operations. With the right balance of speed, security, and insight, you can grow revenue while maintaining a predictable compliance posture across the payment lifecycle.

Frequently Asked Questions

What are the key benefits of mobile payments for businesses, and how do I choose the right mobile payment solutions for businesses (including contactless payments for merchants and digital wallets for business)?

Key benefits of mobile payments for businesses include faster checkouts, improved cash flow, and a seamless omnichannel experience. When selecting mobile payment solutions for businesses, compare cost structures, processing speed, and POS compatibility, and prioritize options that support contactless payments for merchants and digital wallets for business to meet customer expectations. Consider a pilot rollout to measure impact on transaction times, customer satisfaction, and staff adoption before scaling.

How do I ensure PCI compliance for mobile payments and optimize secure payment processing for a small business while supporting digital wallets for business?

To ensure PCI compliance for mobile payments and secure payment processing for a small business, start with data tokenization, encryption, and strict access controls, and confirm who is responsible for PCI scope (processor, software vendor, or your team). Complete the appropriate PCI Self-Assessment Questionnaire (SAQ), schedule regular vulnerability scans, and maintain security hygiene. Also, optimize the offering by supporting digital wallets for business and other payment methods within a compliant, risk-managed framework.

| Key Area | What It Means | Impact for Your Business |

|---|---|---|

| What mobile payments for businesses are | Accepting payments via mobile devices (phones, tablets, or readers) using technologies such as NFC, QR codes, and mobile wallets. It’s more than replacing cards with screens—it’s about a faster, safer, and more flexible checkout experience. | Faster checkouts, scalable and pocketable solutions, and a modern checkout experience that appeals to today’s on-the-go customers. |

| Why this trend matters for growth and resilience | It supports speed and convenience, enables curbside/remote checkouts, and enables omnichannel strategies that blend online and offline sales. It unlocks new revenue streams, improves reconciliation, and provides richer buyer insights. | Quicker transactions, better data, and more adaptable business models across sectors like retail, hospitality, and service-based industries. |

| Core components of a mobile payments strategy | A robust program rests on hardware/software compatibility, security, and an engaging customer experience, combining a payment acceptor with software for processing, reconciliation, and analytics. | A cohesive ecosystem focused on speed, reliability, cost, and ease for staff and customers. |

| 1) Hardware and software foundations | Devices include smartphones with readers, iOS/Android apps, and QR-based checkout; aim for a flexible setup that scales and works with existing systems; consider offline mode and scalability. | Flexible, scalable deployment that supports various sales channels and growth. |

| 2) Payment methods and customer choice | Support multiple methods (credit/debit, digital wallets, QR), quick tap-to-pay with minimal steps, and backups for older methods. | Reduced friction at checkout and higher completion rates; broader customer appeal. |

| 3) Security, compliance, and trust | Tokenization, encryption, and PCI compliance; assess data handling, cloud processing, and fraud-prevention features. | Builds customer trust and protects your business integrity. |

| 4) Data, reporting, and customer insights | Dashboards, real-time receipts, and analytics to optimize pricing, promotions, loyalty, and inventory. | Informed decisions and targeted marketing opportunities. |

| Choosing the right solution: a practical buyer’s guide | Map checkout flow, compare providers by cost, speed, POS compatibility, support, and scalability. Pilot one solution before broad rollout. | Lower risk and faster ROI through controlled experimentation. |

| Implementation steps for a smooth rollout | Align POS/back-office data flow, train staff, configure reporting, and establish a feedback loop to identify friction points. | Quicker user adoption and smoother integration with minimal disruption. |

| Security and compliance deep dive | PCI is ongoing; tokenize, encrypt, and minimize PCI scope. May require PCI SAQ and staff security practices; regular vulnerability scans and password hygiene. | Ongoing protection of customer data and reduced risk exposure. |

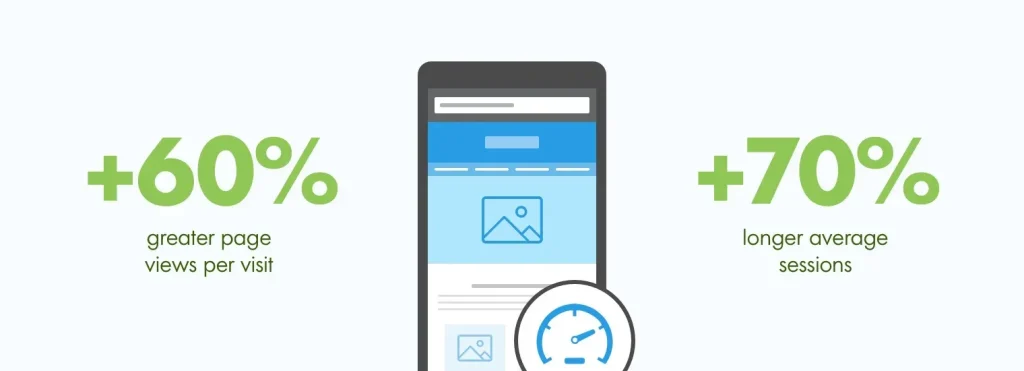

| Practical benefits and real-world considerations | Faster checkouts, higher cart completion, better cash flow. Use data to tailor offers and loyalty, but weigh higher per-transaction fees and hardware costs. | Balanced value: cost versus convenience and revenue gains. |

| Case examples and scenarios | A café sees shorter lines; a mobile car wash enables on-site payments; an e-commerce store expands to pop-ups with QR payments and quick settlement. | Concrete, industry-specific benefits across different business models. |

| The road ahead: trends to watch | Expect expansion into subscriptions, in-app purchases, and cross-border processing with less friction; integration and strong security remain priorities. | A forward-looking view on how mobile payments will evolve and sustain growth. |

| Conclusion | Mobile payments for businesses represent more than a payment method; they’re a strategic tool to enhance customer experience, improve operations, and unlock data-driven growth. Prioritize core components, security, and scalable solutions to stay competitive as the market evolves. | A concise summary that reinforces the strategic value of adopting mobile payments for businesses. |

Summary

Table is in the HTML above. The concluding paragraph emphasizes the strategic value of mobile payments for businesses and highlights key steps to implement a scalable, secure program.